NEWS

| Title | LS Materials Targets Listing on the Stock Exchange within the year, Submits Securities Report |

|---|---|

| Date | 2023-10-23 |

Photograph 1) Employees of LS Materials manufacturing capacitors at Gunpo Factory.

Photograph 2) LS Materials CI

■ First affiliate to list as eco-friendly business following spin-off from LS Group, growing into “keyplayer in the carbon neutrality value chain of the LS Group with growth potential and stability”

■ Supplying products to high-tech industry for electric vehicles, robots, secondary batteries, hydrogen fuel cells, wind turbine generators, ESSs, etc.

■ Partnership with top global EV aluminum manufacturer HAI to expand into the EV parts industry

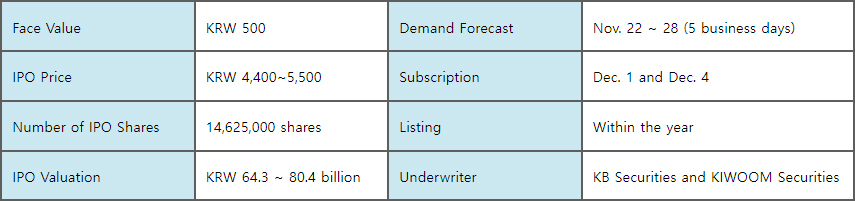

[ LS Materials IPO Overview ]

LS Materials (CEO Young-ho Hong) has announced that the company submitted a securities report to the Financial Services Commission on October 23 and that it is aiming to list on the KOSDAQ in November.

This is the first IPO to take place in an eco-friendly industry since the separation of affiliates from the LS Group, and the second IPO of an affiliate company of LS C&S following the IPO of LS C&S Asia back in 2016.

This IPO will be for 14,625,000 shares with an IPO price per share of between KRW 4,400 and 5,500. The total IPO valuation is projected to be between KRW 64.3 and 80.4 billion.

The IPO price will be finalized through demand forecasting set to take place between November 22 and 28, and general subscriptions will be open to the public on December 1 and December 4. The stock is scheduled to be listed within the year and KB Securities and KIWOOM Securities will serve as co-underwriters.

LS Materials is the leading large product manufacturer in the global market for the ultra capacitors (UC), also known as the ‘next-generation secondary batteries.’

LS Materials CEO Young-ho Hong stated, “The products of LS Materials are used in the high-tech industry for electric vehicles, robots, secondary batteries, hydrogen fuel cells, wind turbine generators, and ESSs.” He added, “We will develop the company as a key player in the carbon neutrality value chain of the LS Group with growth potential and stability by generating synergy with the other affiliates of the LS Group.”

The main business of LS Materials consists of the eco-friendly ultra capacitor (UC) business, as well as aluminum materials and parts.

UCs are high-output energy storage devices that are used in the turbines of wind turbine generators, uninterruptible power supplies (UPS) at semiconductor factories, factory automation, and automated guided vehicles (AGV). UCs offer the advantages of high-speed charge/discharge and long lifespan, and are used to substitute and supplement primary batteries and lithium-ion batteries (LIB).

LS Materials partnered with the top global EV aluminum parts manufacturer HAI, based in Austria, to establish a joint venture back in February.

Based on the high-strength lightweight aluminum manufacturing technology of LS Materials and the experience of HAI, a supplier to Daimler AG, BMW, etc., the joint venture is expected to generate approximately KRW 200 billion in sales by 2027 by mass manufacturing battery cases and other parts starting in 2025.

LS Materials began R&D under LS C&S in 2002 and has supplied products to over 500 companies worldwide for the past 20 years.

As of last year, the company posted consolidated sales of KRW 161.9 billion, operating profits of KRW 14.4 billion, and a current net income of KRW 8.4 billion. These figures have increased by approximately 28% and 73%, respectively, compared to the previous year with the increase in exports to the North American region. The semi-annual performance of the company this year so far consists of sales of KRW 70.8 billion, operating profits of KRW 8.2 billion, and current net income of KRW 7.1 billion.